« The Montreal real estate market is once again in full swing. I have been working in the real estate industry for 30 years, in the heart of Montreal’s main neighbourhoods. People invest their savings in a home purchase and the market offers them an interesting return. That is, provided that you buy your property and hold on to it for some time. » Nathalie Clément director at Via Capitale du Mont-Royal

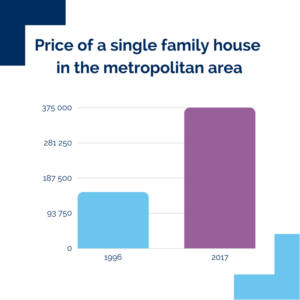

In 1996, a single-family home cost approximately $150,000 in the metropolitan area, while in 2017, the cost was around $375,000. This price increase is the result of an appreciation of the market combined with a decline in interest rates. It should be noted that people’s purchasing power is comparable to that of 30 years ago, since mortgage interest rates were around 16% then, and are around 3.5% now. Ironically, a household that purchased a condo for $100,000 in 1990 had a monthly payment of about $1,250. Today, a $375,000 condo has a mortgage payment of about $1,700 per month. Imagine the effort needed for a family to make monthly payments on the salary of 30 years ago… The current increase in house sales prices is a result of the catch-up effect of the market, which increased little in recent years. The Montreal real estate market operates in the following manner: a period of stability and/or minimal price increases is followed by a sudden and intense price growth.

We are in the midst of one of these booms in 2018.

Our daily operations at the agency are currently filled with buyers and sellers who, all motivated to move properties, are quite surprised with the results of their negotiations. As brokers, we conduct market studies to set the selling price of properties; we do so by looking at the price of similar properties that were recently sold. We then adjust our calculations by using our expertise, examining various factors, and according to what buyers are currently ready to pay for such a property.

In a catch-up market, it’s usually the buyers who surprise us. Indeed, they are the ones who dictate the market and decide on the price offered, so that sellers can transfer ownership. Very often, this leads to a promise to purchase that is finalized by a notary at a higher price than what the seller originally asked. Which gives rise to the following situation: several families looking to buy a property will make a promise to purchase at the same time and for the same place. Clearly, the seller will accept the best offer. This will result in several disappointed buyers who saw their offers rejected, as well as one happy buyer who managed to be the successful bidder.

This is what professionals call a seller’s market. Current conditions favour sellers during negotiations. Many buyers feel discouraged at this moment, and with good reason. Sometimes they fall head over heels for a property, make a promise to purchase, and, having not offered the highest price, are rejected by the seller. Sometimes this occurs several times in a row. Tell yourself that if you want to buy in a market that favours sellers, you’ll need to use the same logic as the other buyers who are looking to outbid you: you’ll have to offer more. And in this booming market, logic is not really a factor! Your maximum price should be set at an amount where you won’t regret losing out on the property to another buyer.

If you’re not ready to outbid others, it may be better to rent rather than buy. Or you could always wait for the market to settle down, let’s say for a year, to then negotiate a better price. One thing is for sure: the market’s catching-up is well on its way, and has been in effect for over six months. It’s not just the temporary effect of a particular real estate market. This means that houses sold in the spring of 2018 will serve as the new comparison point on which to base the property prices for upcoming years.

The leap forward is in full force: prices have gone up and continue to rise. If it remains consistent with its historical trajectory, the real estate market in Montreal will certainly be less bullish in the coming years. On the other hand, betting on a short-term price drop is also unlikely. Those who resell their property after a short-term ownership risk losing out financially, since they initially overbid at the time of purchase. That’s why it’s important to make a purchase for a minimum of 5 years before looking to resell. It’s also why the Montreal real estate market has been doing so well for so long: because people are buying to stay or to invest, not to speculate.

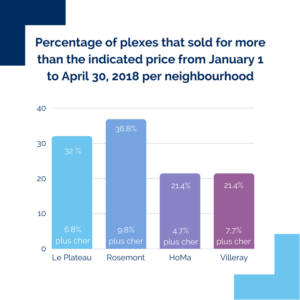

Some figures, for example:

In the Plateau Mont-Royal neighbourhood this year, 32% of plexes sold between January 1st and April 30th were sold at a higher price than listed on the MLS. On average, these condos sold for 6.8% more than the price asked by sellers.

In the Rosemont area, 36.8% of plexes were sold at a cost that was 9.8% higher than the price asked by sellers.

Same scenario in Hochelaga Maisonneuve: 21.4% of plexes were sold at a cost that was 4.7% higher than hoped for by the sellers.

And finally Villeray: 21.4% of plexes received offers that were 7.7% higher than the listed price.

Feel free to contact a broker from our agency for more details. They can be at your side throughout the process to make sure your interests are well-represented and can guide you in this booming market.